OpenEvidence Announces $200 Million Funding Round Valuing Company at $6 Billion

Key Points

- OpenEvidence raised $200 million, valuing the company at $6 billion.

- The round follows a $210 million raise three months earlier at a $3.5 billion valuation.

- The AI platform is trained on leading medical journals such as JAMA and NEJM.

- Verified medical professionals can use the tool for free, supported by advertising.

- Monthly clinical consultations have nearly doubled to about 15 million since July.

- Google Ventures led the financing, with Sequoia, Kleiner Perkins, Blackstone, Thrive Capital, Coatue, Bond, and Craft participating.

- Founded in 2022, OpenEvidence aims to provide rapid, evidence‑based answers to clinicians.

- The funding underscores strong investor interest in specialty AI applications for health care.

OpenEvidence, a medical AI platform likened to ChatGPT for doctors, disclosed a $200 million financing round that values the startup at $6 billion. The new capital follows a $210 million raise three months earlier at a $3.5 billion valuation. Trained on leading medical journals, the tool provides rapid answers to clinical questions for verified professionals, who can use it for free supported by advertising. Since its 2022 founding, OpenEvidence has seen clinical consultations per month nearly double to 15 million. The round was led by Google Ventures with participation from multiple top venture firms.

Funding Announcement

OpenEvidence, a technology company that markets an AI‑driven platform often described as "ChatGPT for medicine," announced a new financing round of $200 million. The infusion of capital brings the company’s valuation to $6 billion, according to the report. This round arrives just three months after the startup closed a $210 million round that valued it at $3.5 billion, underscoring strong investor appetite for specialized artificial‑intelligence solutions in health care.

Company Background

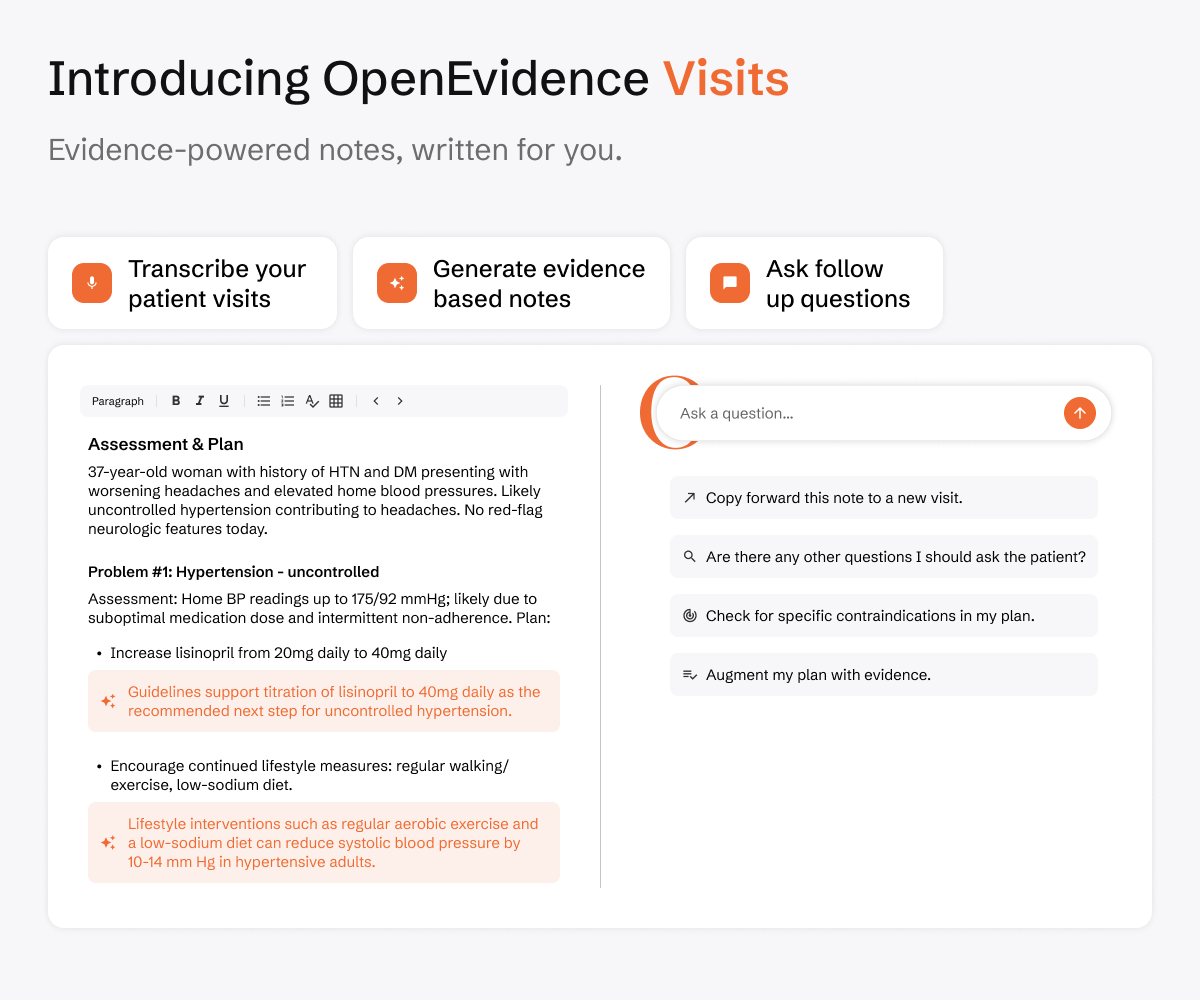

Founded in 2022, OpenEvidence has positioned itself at the intersection of large‑language‑model technology and clinical knowledge. The platform is trained on reputable medical publications, including the Journal of the American Medical Association (JAMA) and the New England Journal of Medicine (NEJM). By leveraging this curated data, the service helps health‑care professionals quickly retrieve answers to existing medical knowledge, supporting patient treatment decisions.

Product and Market Position

OpenEvidence offers its tool to verified medical professionals at no cost, with the service funded through advertising. The model aims to provide clinicians with fast, reliable information without the need for a paid subscription, differentiating it from other AI offerings that rely on direct user fees. The platform’s focus on evidence‑based answers aligns with the growing demand for trustworthy AI assistance in clinical settings.

Growth Metrics

Since its inception, the company has experienced rapid adoption. Clinical consultations processed by the platform have nearly doubled, reaching approximately 15 million per month as of July. This surge reflects both the expanding user base and the increasing reliance on AI tools for day‑to‑day medical decision‑making.

Investor Participation

The latest financing round was led by Google Ventures. Additional participants include Sequoia Capital, Kleiner Perkins, Blackstone, Thrive Capital, Coatue Management, Bond, and Craft. The involvement of these prominent venture firms highlights confidence in OpenEvidence’s technology and its potential to reshape information access for health‑care providers.

Outlook

With substantial new capital and a valuation that places it among the most valuable AI startups, OpenEvidence is positioned to scale its platform, deepen its data integrations, and expand its user community. Industry observers note that the company’s growth trajectory and investor backing suggest a continued push toward mainstream AI adoption in clinical environments.