Figure Secures Series C Funding Valuing Company at $39 Billion

Key Points

- Figure raises a Series C round exceeding $1 billion.

- Company valuation reaches $39 billion.

- Funding led by Parkway Venture Capital with participation from Brookfield, Nvidia and Intel Capital.

- Capital will expand robot fleet, training infrastructure, and data‑collection efforts.

- Total capital raised since 2022 approaches $2 billion.

- CEO Brett Adcock describes Figure as a highly sought‑after private stock.

- Company protects share sales with cease‑and‑desist letters to unauthorized brokers.

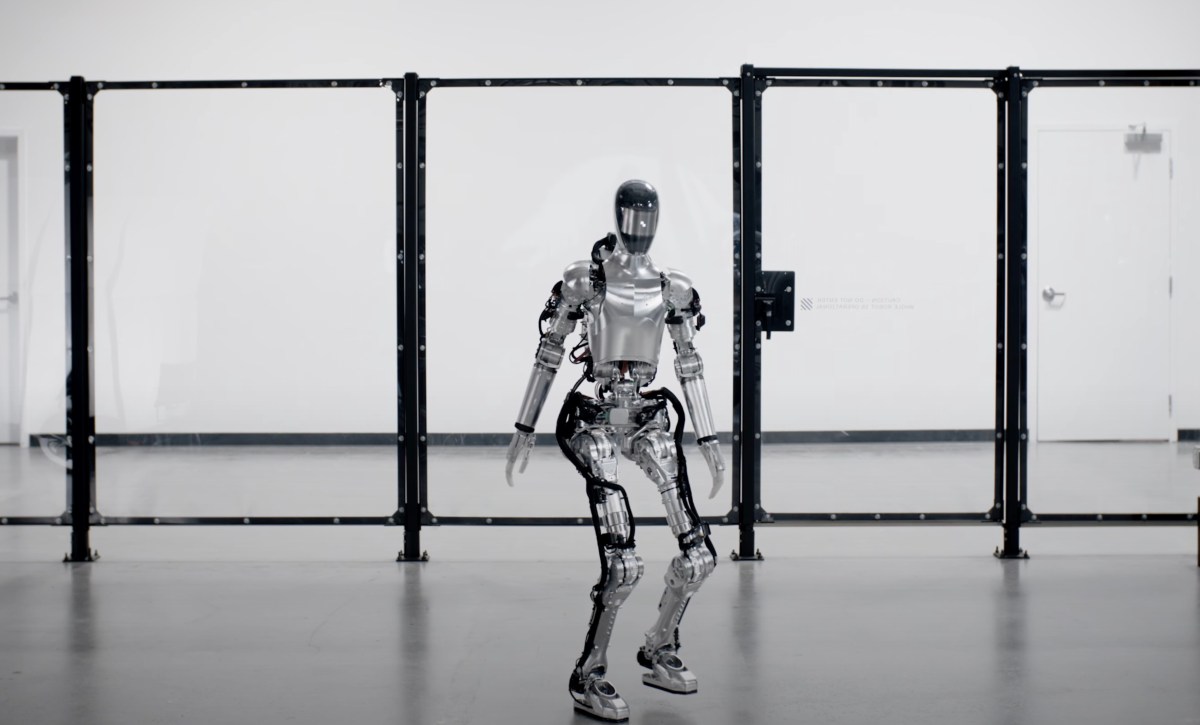

San Jose‑based humanoid robotics firm Figure announced a Series C financing round that values the company at $39 billion. Led by Parkway Venture Capital with participation from Brookfield Asset Management, Nvidia and Intel Capital, the round exceeded $1 billion. Figure plans to expand its robot fleet, accelerate training infrastructure, and boost data‑collection capabilities. The funding brings the company’s total capital raised to nearly $2 billion since its 2022 founding.

Funding Round and Valuation

Figure, a developer of humanoid robots designed for collaborative work environments, disclosed that it has completed a Series C financing round that places the company’s valuation at $39 billion. The round, described by the company as exceeding $1 billion, was led by Parkway Venture Capital. Additional participants include Brookfield Asset Management, Nvidia and Intel Capital, among others.

Use of Capital

The company indicated that the new capital will be directed toward scaling its fleet of humanoid robots, building the infrastructure needed to accelerate robot training, and launching advanced data‑collection initiatives. These efforts are intended to support deployment of the robots across warehouses, factories and other settings where human‑robot collaboration can improve efficiency.

Company Background and Growth

Founded in 2022, Figure has rapidly attracted investor interest, positioning itself as a leading player in the emerging market for collaborative robotics. Since its inception, the firm has raised nearly $2 billion in funding, reflecting strong confidence from the venture capital community and strategic technology partners.

Leadership Perspective

CEO Brett Adcock has previously described Figure as one of the most “sought‑after” private‑market stocks. The company’s aggressive fundraising strategy underscores its ambition to dominate the humanoid robotics sector and to deliver scalable solutions that integrate seamlessly with human workers.

Market Implications

The sizable valuation and the involvement of major technology investors such as Nvidia and Intel Capital signal a broader industry belief in the potential of humanoid robots to transform labor‑intensive operations. Figure’s ability to secure this level of financing suggests that its technology and business model are resonating with both investors and potential enterprise customers.

Regulatory and Secondary Market Actions

In parallel with its fundraising activities, Figure has been actively protecting its shareholder rights by issuing cease‑and‑desist letters to secondary‑market brokers that lack authorization to sell its shares. The company clarified that such letters are standard practice when unapproved brokers attempt to facilitate transactions.